Advancing the global goals together

“The Pact for the Future, as well as the SDG Political Declaration of 2023, have given us the chance to define a common vision to advance sustainable development. Now is the time to reaffirm our collective commitment to the 2030 Agenda and to take decisive action to address today’s interlocking crises,” says Mr. Rae.

The 2030 Agenda for Sustainable Development and its 17 Sustainable Development Goals (SDGs) are shared pathway to building an inclusive, peaceful, thriving and healthy world for all. We must act now, and act boldly. With only five years remaining, we cannot afford to lose momentum on our 2030 promise. The time for words has passed, now is the time for action.

This call to action comes at a moment of global urgency. The world is facing multiple, overlapping crises—from conflict and economic slowdown to rising inequalities, and an accelerating climate emergency. The implementation of the SDGs has become more critical than ever. Alarming, acute hunger reached a record high in 2025 with 343 million people experiencing severe food insecurity. According to the United Nations, the number of forcibly displaced people reached 122.1 million by the end of April 2025.

“Urgent action is critical to reverse alarming trends and consolidate hard-won gains,” said UN Secretary-General António Guterres. “While progress has been uneven and limited on several Goals, notable achievements across regions and countries demonstrate that change is possible.”

Even though extreme poverty has declined around the world despite the profound impact of the global pandemic, there are still over 700 million people living in extreme poverty, and the risk of falling into, or back into, poverty remains high, driven by compounded shocks and crises.

This year’s UN Ocean Conference, Fourth International Conference on Financing for Development, Second World Summit for Social Development, and the High-level Political Forum on Sustainable Development (HLPF) provide important opportunities to strengthen and revitalize multilateralism. In an increasingly interconnected world, these global gatherings serve as essential platforms for fostering inclusive, coordinated, and effective international cooperation for both people and the planet.

As UN DESA’s Under-Secretary-General Li Junhua said, “bold actions are essential to turn the corner and show the world that multilateralism can still deliver.”

Countdown to 2030: How the HLPF is turning commitment into action and impact

On the cusp of the 10th anniversary of the adoption of the 2030 Agenda for Sustainable Development, which launched the Voluntary National Reviews (VNRs), thirty-seven countries will present bold actions they have taken to advance the SDGs at the High-Level Political Forum on Sustainable Development, to be held on 14-23 July at UN Headquarters in New York.

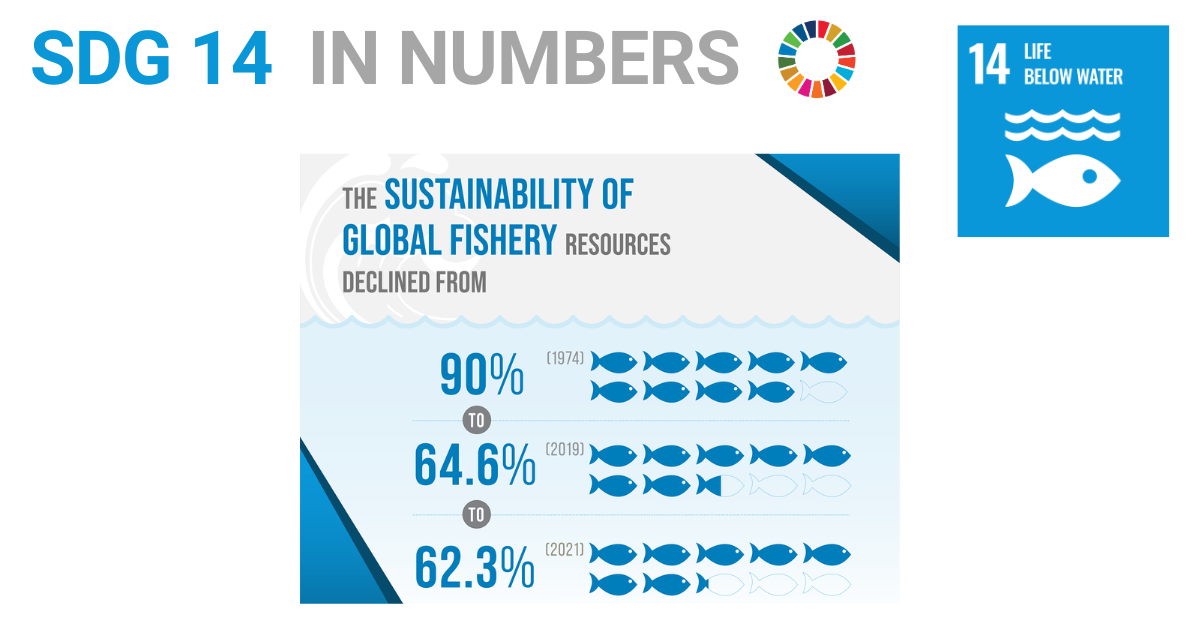

Under the theme, Advancing sustainable, inclusive, science- and evidence-based solutions for the 2030 Agenda for Sustainable Development and its Sustainable Development Goals (SDGs) for leaving no one behind, the HLPF will review in depth Goals 3 (good health and well-being), 5 (gender equality), 8 (decent work and economic growth), 14 (life below water) and 17 (partnerships for the goals) will be reviewed in depth.

The HLPF will also feature a series of special events and close to 190 side events (on-site, off-site and virtual) bringing together governments, international organizations, the private sector and other key stakeholders engaged in the SDGs implementation.

Get the latest event updates on the HLPF website here and follow live via UN Web TV.

Expert Voices

Meet the experts helping chart a course to a more sustainable future

When tackling the world’s biggest challenges — from deepening inequalities and economic uncertainty to the climate crisis — it helps to have some of the sharpest global minds at the table. That’s the role of the UN High-level Advisory Board on Economic and Social Affairs (HLAB), a group of 22 distinguished thought leaders in fields such as economics, finance, demography, the environment, and gender equality.

Convened by UN DESA, this diverse group includes former Heads of State, a Nobel Laureate, former senior government officials and intellectual leaders from all regions. They offer independent, cross-disciplinary insights to help shape the UN thinking on sustainable development and bring us closer to a world that leaves no one behind.

The HLAB recently launched its third term with a multi-day session in Bangkok, Thailand. These meetings, held twice a year, are led by UN DESA Under-Secretary-General Li Junhua and include participation from the Principals of the UN Regional Commissions and UNCTAD, among other special guests. Key takeaways are shared with senior UN leadership—including the Secretary-General—to inform decision-making in support of sustainable development.

But the HLAB’s impact goes beyond internal discussions.

Through the UN DESA Global Policy Dialogue Series, HLAB members engage and share their expertise directly with the public—from civil society, students, policymakers and people working toward achieving the Sustainable Development Goals (SDGs). In Bangkok, members participated in an interactive policy dialogue at Chulalongkorn University titled “Converging Crises, Shared Solutions: Applying Lessons from Asia and the Pacific to Global Challenges,” showcasing SDG good practices for an online and in-person audience.

Before the next HLAB meeting this fall, many of them will participate in Policy Dialogues alongside major UN events in July, including the Fourth International Conference on Financing for Development (FFD4) and the High-level Political Forum on Sustainable Development (HLPF). By connecting global expertise with inclusive dialogue, HLAB is helping to turn big-picture goals into concrete actions and lighting the way toward a more sustainable future for all.

For the full list of HLAB members, please visit the HLAB website. To register for the upcoming Policy Dialogues at FFD4 and HLPF, please visit the Policy Dialogues website.

Things You Need To Know

4 things you should know about the latest data on SDG progress

This month, the world will come together at the High-level Political Forum on Sustainable Development (HLPF) to assess where we stand in our joint efforts to achieve the 17 Sustainable Development Goals (SDGs). Where are we advancing, and where are we falling behind? To guide this work, UN DESA’s Statistics Division is launching the latest Sustainable Development Goals Report 2025. Here are 4 things you need to know.

1. The report provides a comprehensive picture of global progress

With only five years left to achieve the SDGs, the report provides a comprehensive picture of global progress and gives readers a compelling reminder of why the Goals matter now more than ever for our shared future. 10 years into the implementation of the 2030 Agenda, the report highlights notable achievements in some key areas: new HIV infections have dropped by 39 per cent since 2010; malaria prevention efforts have saved 12.7 million lives; and 110 million more children and youth are in school now than in 2015. Internet access has surged 70 per cent since 2015 and electricity now reaches 92 per cent of the world’s population. These are numbers reflect real progress made and real lives transformed.

2. Data reveals a harsh reality for many

At the same time, the report reveals some harsh realities. One in 11 people still suffer from hunger, and billions lack access to safe drinking water, sanitation, and hygiene. Gender inequality persists with women performing 2.5 times as many hours per day of unpaid care work as men. The global landscape is growing more challenging: escalating conflicts, growing geopolitical tensions, record-breaking global temperatures, unsustainable debt burdens, and a staggering $4 trillion annual financing gap that hinders progress in developing countries.

3. Scaled up actions and solutions can advance progress

Despite these obstacles, the message is clear: progress is possible if we scale up solutions and build on hard-won gains. Grounded in the latest evidence, the 2025 edition of the report will help shape policy discussions at the HLPF and guide evidence-based decisions to get the SDGs back on track.

4. Follow the report launch on 14 July to get the latest SDG data

UN DESA will launch this flagship report on the first day of the High-Level Political Forum on Sustainable Development on 14 July. Stay tuned for the launch event and be sure to check out the complete report which will be available at 12:30 pm EDT on 14 July 2025 here: The Sustainable Development Goals Report 2025

Photo credit: UNICEF/Meerzad

More from UN DESA

Read more here: https://desapublications.un.org/un-desa-voice/july-2025